The US ADP Employment Change for April is predicted at 800K. Forex traders can compare this to the US ADP Employment Change for March, reported at 517K. The US ISM Non-Manufacturing PMI for April is predicted at 64.3. Forex traders can compare this to the US ISM Non-Manufacturing PMI for March, reported at 63.7. The ISM Non-Manufacturing Business Activity Index for April is predicted at 69.5. Forex traders can compare this to the ISM Non-Manufacturing Business Activity Index for March, reported at 69.4.

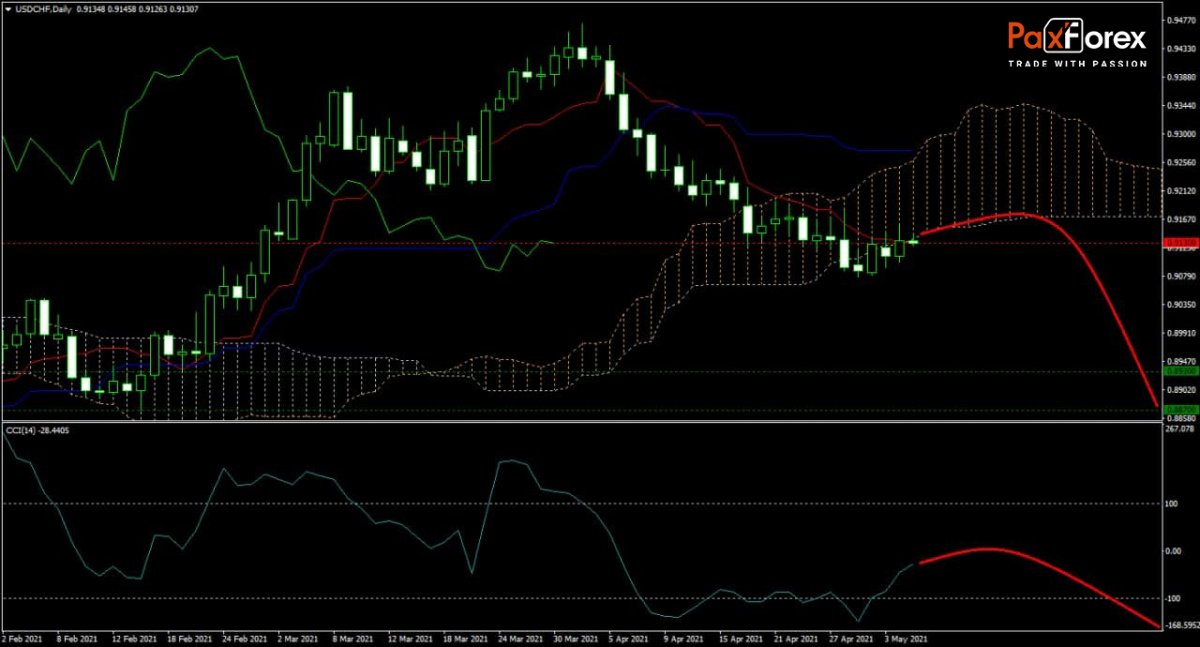

The forecast for the USD/CHF remains bearish after this currency pairs moved below its flatlining Ichimoku Kinko Hyo Cloud. Risk appetite continues to deflate, with economic data showing signs of easing from the stimulus boost. The Tenkan-sen continues to contract, and the Kijun-sen holds on to its gradual drift lower. After the CCI moved out of extreme oversold territory, traders should monitor price action for signs of weakness and sell any rallies.

Should price action for the USD/CHF remain inside the or breakdown below the 0.9100 to 0.9170 zone, recommend the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.9130

- Take Profit Zone: 0.8870 – 0.8930

- Stop Loss Level: 0.9200

Should price action for the USD/CHF breakout above 0.9170, recommend the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.9200

- Take Profit Zone: 0.9275 – 0.9310

- Stop Loss Level: 0.9170

Apple | Fundamental Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis