US Initial Jobless Claims for the week of March 6th are predicted at 725K, and US Continuing Claims for the week of February 27th are predicted at 4,220K. Forex traders can compare this to US Initial Jobless Claims for the week of February 27th, reported at 745K, and to US Continuing Claims for the week of February 20th, reported at 4,295K. US JOLTS Job Openings for January are predicted at 6.600M. Forex traders can compare this to US JOLTS Job Openings for February, reported at 6.646M.

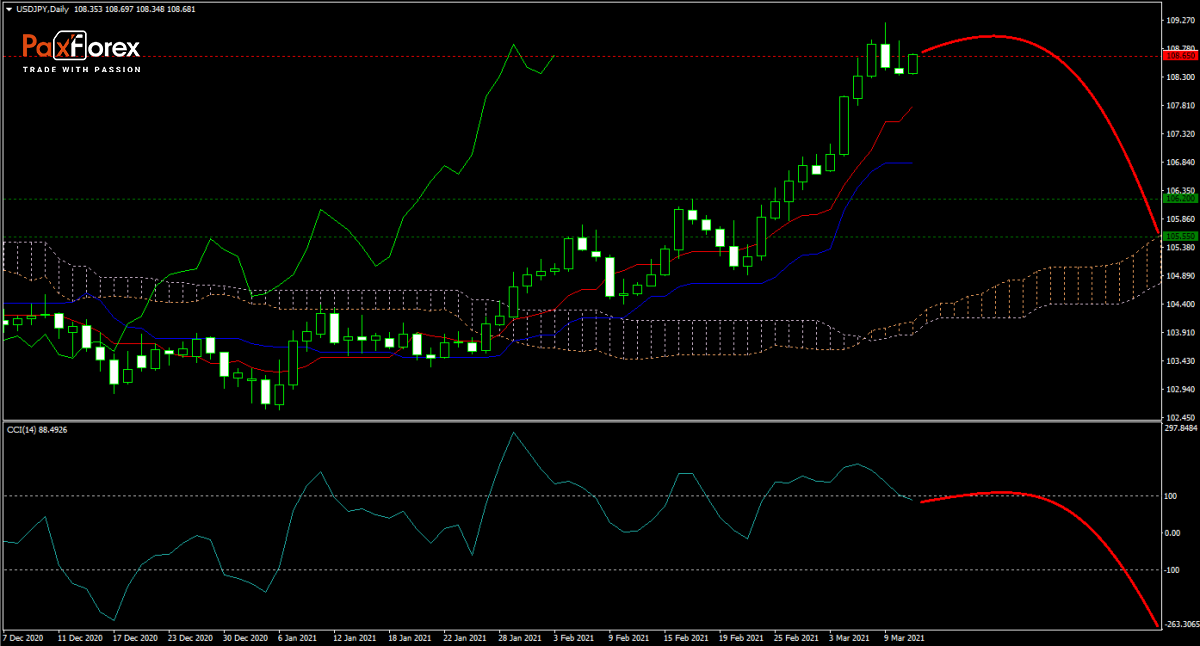

The forecast for the USD/JPY turned bearish after the most recent advance shows signs of weakness. While the Tenkan-sen maintains its ascend, the Kijun-sen turned sideways. Tame US inflation data yesterday added to short-term optimism while economic clouds gather. Traders should position themselves for a correction in this currency pair into its ascending Ichimoku Kinko Hyo Cloud. The breakdown in the CCI out of extreme overbought territory added bearish pressures.

Should price action for the USDJPY remain inside the or breakdown below the 108.350 to 108.900 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 108.650

- Take Profit Zone: 105.550 – 106.200

- Stop Loss Level: 109.400

Should price action for the USDJPY breakout above 108.900 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 109.400

- Take Profit Zone: 110.300 – 110.950

- Stop Loss Level: 108.900

Disney | Fundamental Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis