US Preliminary Durable Goods Orders for March are predicted to increase by 2.5% monthly, and Durables Excluding Transportation are predicted to increase by 1.6% monthly. Forex traders can compare this to US Durable Goods Orders for February, which decreased by 1.2% monthly, and to Durables Excluding Transportation, which decreased by 0.9% monthly. Capital Goods Orders Non-Defense Excluding Aircraft for March are predicted to increase by 1.5% monthly. Forex traders can compare this to Capital Goods Orders Non-Defense Excluding Aircraft for February, which decreased by 0.9% monthly.

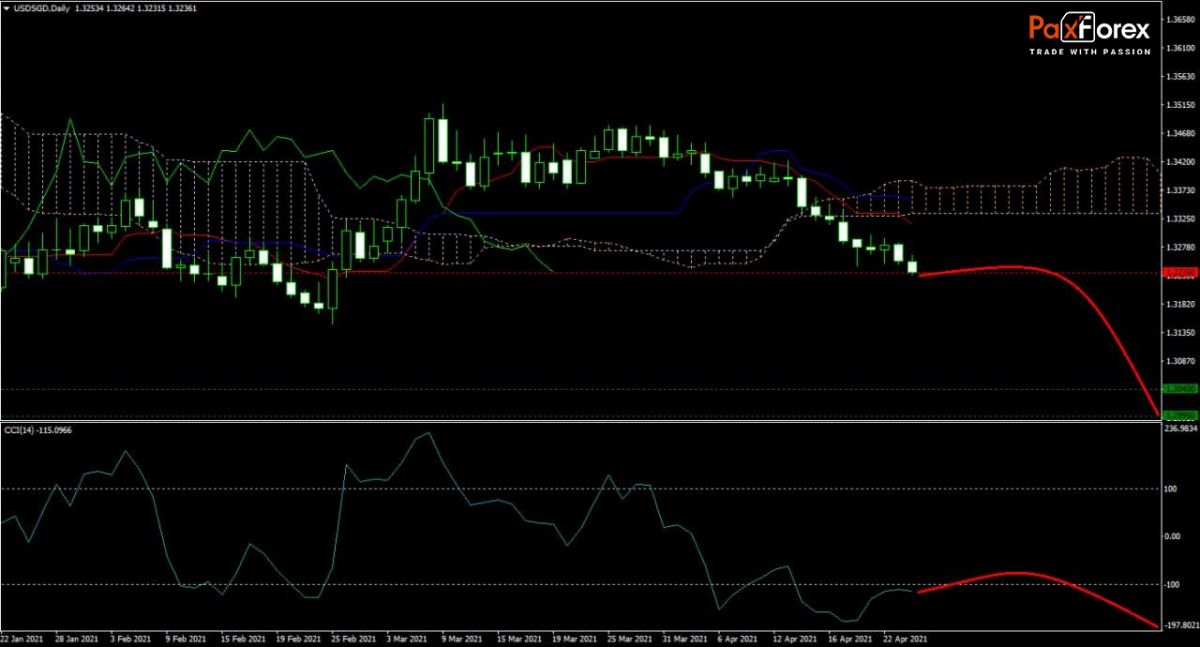

The forecast for the USD/SGD remains bearish, with the Tenkan-sen and the Kijun-sen drifting lower. With the global Covid-19 pandemic at or near record highs and the double-mutation out of India of particular concern, the economy remains under pressure. The Ichimoku Kinko Hyo Cloud trends sideways while narrowing, with an increase in bearish momentum. After the CCI moved into extreme oversold territory, traders should remain patient and wait for a breakout before selling the rallies in this currency pair.

Should price action for the USD/SGD remain inside the or breakdown below the 1.3195 to 1.3280 zone, recommend the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.3235

- Take Profit Zone: 1.2995 – 1.3040

- Stop Loss Level: 1.3335

Should price action for the USD/SGD breakout above 1.3280, recommend the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.3335

- Take Profit Zone: 1.3425 – 1.3475

- Stop Loss Level: 1.3280

CocaCola | Coca-Cola | Fundamental Analysis

EUR/JPY | Euro to Japanese Yen Trading Analysis

Recent articles

EUR/JPY | Euro to Japanese Yen Trading Analysis